Intervention Through Impact Investing

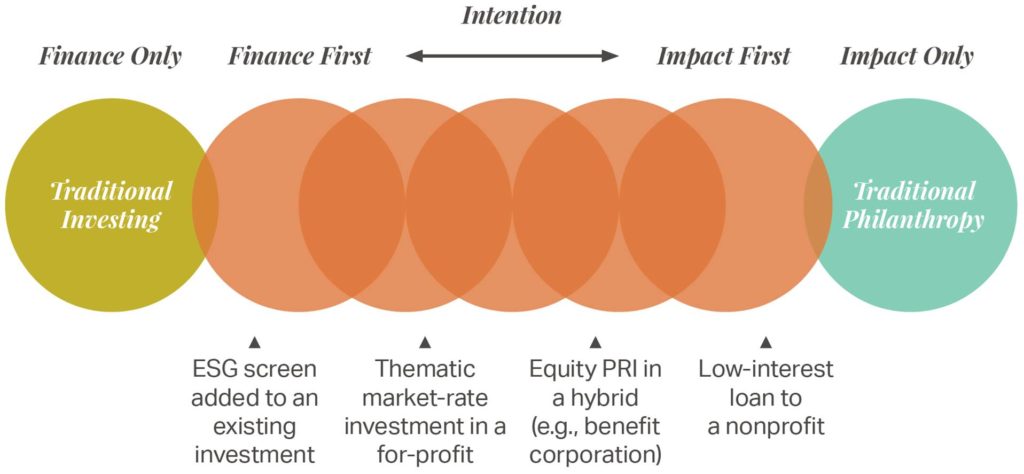

Today, we see an overlapping spectrum of projects, from purely philanthropic with no expectation of financial return, to maximizing alpha regardless of impact. Our clients typically strive to achieve a double bottom line, with returns that range from below to significantly above market-rate.

CSRspace curates projects to make them suitable for a range of investors. Private sector impact financing can rationalize spending, as it requires a return-on-investment, and demands that attention be paid to key performance indicators. This helps lead, frame, and absorb both change and investment in a more agile way than is available to most public sector organizations.

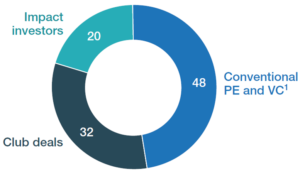

Carefully curated projects are also conducive to "Club Deals" - combining impact investors and conventional PE and VC funds. These deals contributed 32 percent of capital and highlight the complementary role of both kinds of investors. As enterprises mature and impact investors remain involved, they are able to pull in funding from mainstream funds (cumulative investments 2010-2016, source: McKinsey).

A study by the United Nations Conference on Trade and Development (UNCTAD) identified that achieving the SDGs will take between US$5 to $7 trillion, with an investment gap in developing countries of about $2.5 trillion. In this scenario, the role of the private sector is critical as it can bring agility in delivery and new approaches to financing the SDGs.

Source: UNEP Finance Initiative and UN Global Compact