Approach

At CSRspace we believe that successfully enabling entrepreneurs in developing countries to build and scale small and medium enterprises (SMEs) is critical on the local and global levels. This includes focusing on durable economic growth, environmental diligence, good governance, development of a local supply chain and entry into the global markets, sustainable job creation for an inclusive and fairly paid workforce.

It is clear that access to finance is only part of the issue. Many start-ups/SMEs also need ongoing technical and management support – from helping them strengthen their financial practices to adhering to high Environmental, Social, and Government (ESG) standards. Ultimately, the lack of sustained support means that they are unable to grow and create jobs.

Financial Support

Patient capital helps startups and SMEs to become financially viable and scalable so they can attract follow-on capital

- Evergreen Fund

- Alternate model to typical 2/20 term-limited VC funds

- Open-ended fund

- No set time window for raising capital

- No term limits, no forced exits

- Nurtures development of operating companies

Evergreen funds come with inherent challenges:

- Provide liquidity for investors while maintaining an open-ended fund structure

- May not match risk/return expectations

- BUT: there are ways to mitigate

Repayment of loans follows the Demand Dividend model:

- Fixed percentage of free cash flow from operations

- Expires when a set multiple of the initial investment has been paid back

Technical & Management

Startups and SME need a variety of mature operational capabilities so they can compete with established businesses. Examples include

- Marketing and sales channels, supply chain, legal documents, tax reporting

- Industry best practices including Digital Transformation and use of cloud-based services.

- Governance to ensure sustainability

- Monitoring and reporting of support for select SDGs

- Managed capacity building

- Proper accounting to enable follow-up financing

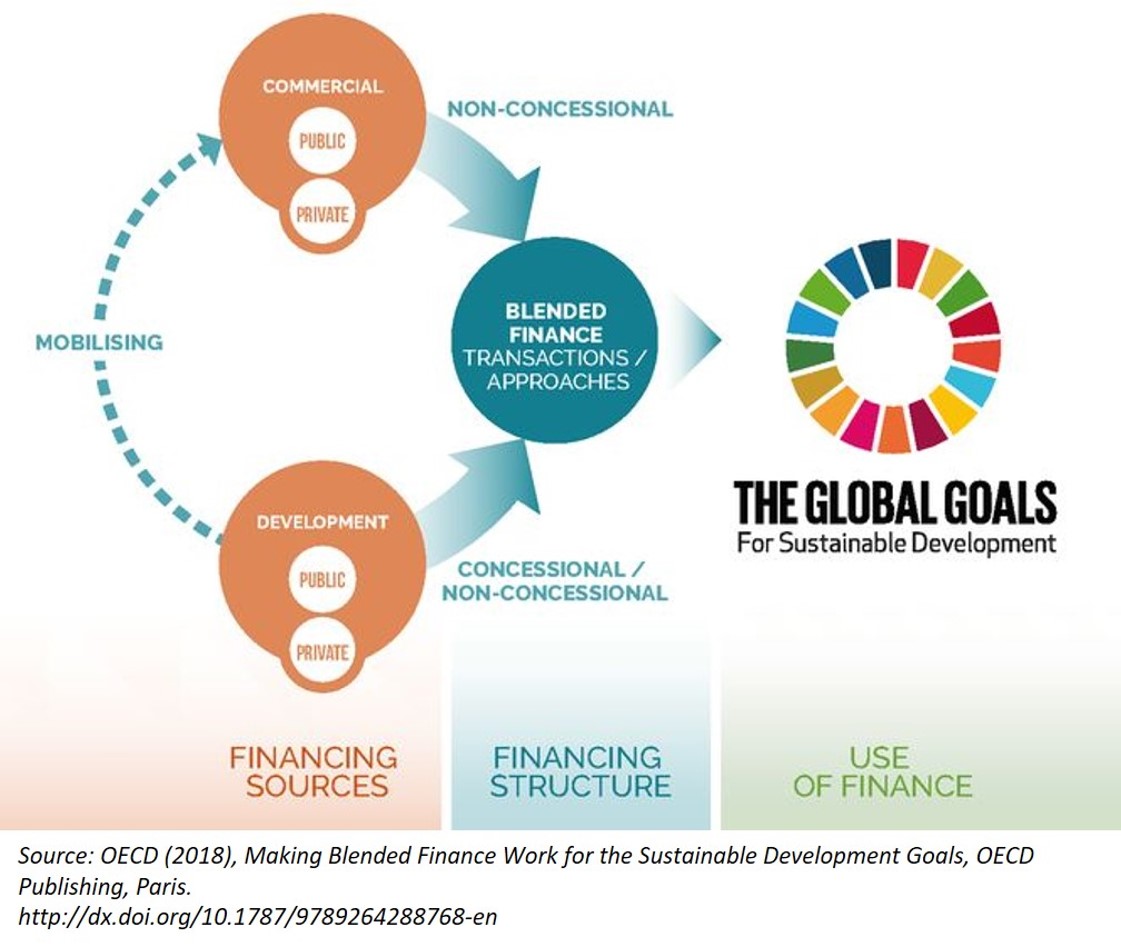

The approach aims to decouple investors and investees through the combination of a permanent capital fund (the market-facing intermediary) and a holding company (the holdco, a community-facing intermediary). This should attract greater amounts of capital for the portfolio companies by providing conventional investors with access to an aggregate portfolio of investments that would not individually meet investor target requirements. The holdco takes pressure off the entrepreneurs through the safety of salaried employment while maintaining the upside of equity participation. The services platform, with shared access by all companies in the portfolio, would assure end-to-end sustainability closely aligned to ESG principles as well as with United Nations Sustainable Development Goals (SDGs).