Sustainability is akin to living within one’s means. Not just in terms of careful use of resources, but also through managing the impact of one’s footprint. Whether one looks at Climate Change, a fixture in public debate; or environmental impacts leading to air pollution, micro plastics and solvents in water; or social issues such as inequality; or even the consequences of inappropriate book keeping – one finds egregious and unsustainable practices.

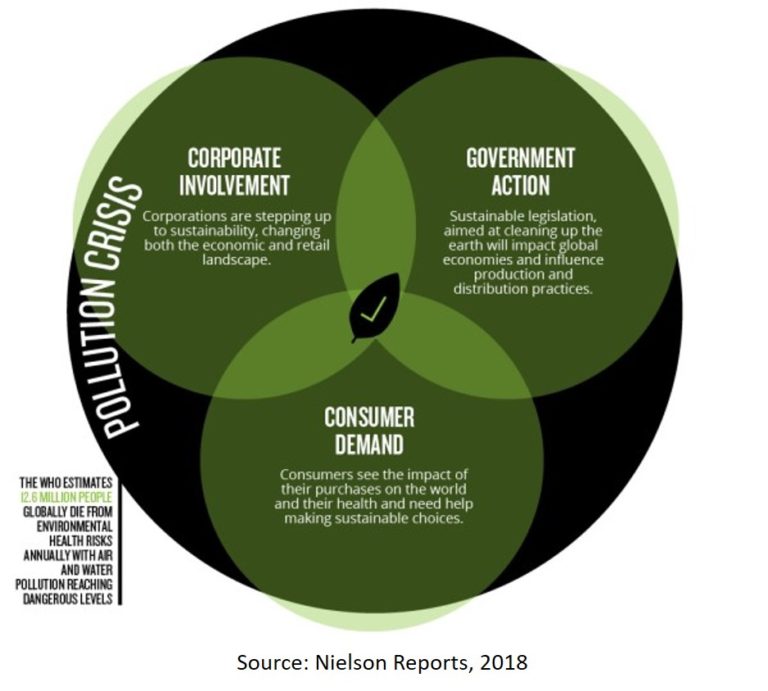

Some activities are regulated by government, some are obvious to consumers, many are being dealt with by corporations. Too often the consumer expects to be protected by a government, which is lobbied by corporations to contain costs of regulations, while seeking lower purchase prices on goods.

Certain unsustainable impacts and related aspects are more visible to investors. Corporations address these concerns with increasing ink in annual reports. Some of the areas for concern tend to be emotional. Regardless of focus, there is plenty of space for greenwashing, since relative comparisons among good and bad practices within an industry are often lacking.

We need a conversation that sets reasonable and sustainable goals.

What is a sustainable practice in each industry? How can it be reported such that

(a) consumers can make a buying decision, and investors an investment decision

(b) how can corporations reduce their negative impact, increase beneficial impacts, and measure and report on the difference.

It often makes financial and market sense for corporations to become sustainable. A complex array of data collection initiatives, which observe no common data quality objectives, and make unquantifiable emotional judgements about sustainability as often hold them back. There are too many standards emerging. Too many data sets exist. The data cannot be compared, even within an industry.

ESG data is most often self-reported. There are issues of reliability and consistency for a corporation, let alone within an industry. The data has only been collected for less than a decade. Indexes are dominated by large-cap companies, as smaller companies do not invest in as comprehensive ESG reporting. Coverage is particularly patchy in areas such as Emerging Markets. Data providers have their own weighting for ESG metrics, and their scores therefore have a low correlation with one another.

Overall, such data collection is highly individual – synergies and collaboration among industries is not encouraged except at very localized levels, there is a barrier between industry and government, and often when industry takes the lead, the consumer is not properly informed, continuing to believe that industry is the bad player, with insufficient governance. There needs to be a levelling of the discussion, and a better establishment of data quality objectives, to enhance reliability of and trust in actionable data.